If you’re taking part in one of our paid teaching placements, you might be wondering if and how you will pay tax on your earnings. In most cases the answer is yes, so you’ll be pleased to know it’s quite straightforward. Like in most countries, income tax in China is calculated at a progressive rate and is taken from your salary before it reaches your account.

Many schools advertise the salary after tax, but this isn’t always the case. We advise checking this with your potential employer before signing a contract to avoid any nasty surprises.

Resident vs Non-Resident Status

Tax laws which came into effect on 1st January 2019 state that a foreign expat worker who lives and works in China for more than 5 consecutive years will be considered a tax resident. Foreigners who fall into this bracket are required by law to pay tax on their worldwide income after the 183rd day of their sixth year in China. During this time, if a foreign worker leaves China for 31 consecutive days, they ‘reset the clock’ so to speak, and the 5-year exemption begins again upon their return. Unless you reach your 6th uninterrupted year, you will be considered a Non-Resident.

Though it’s unlikely that this law will affect those on our teaching placements, it’s good to understand your entitlements.

How much tax will I pay?

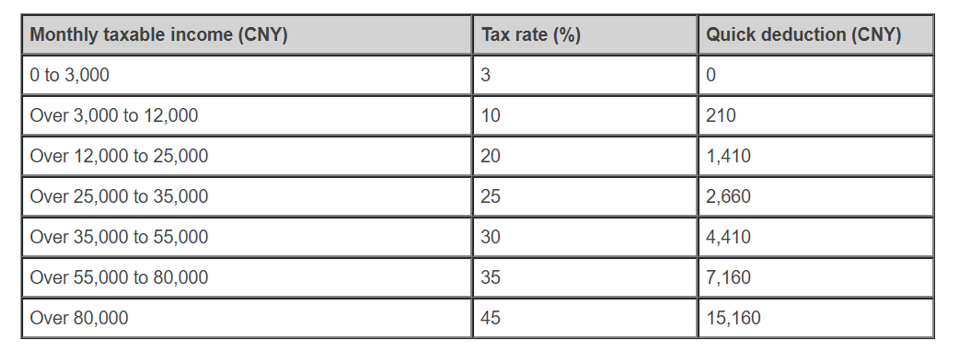

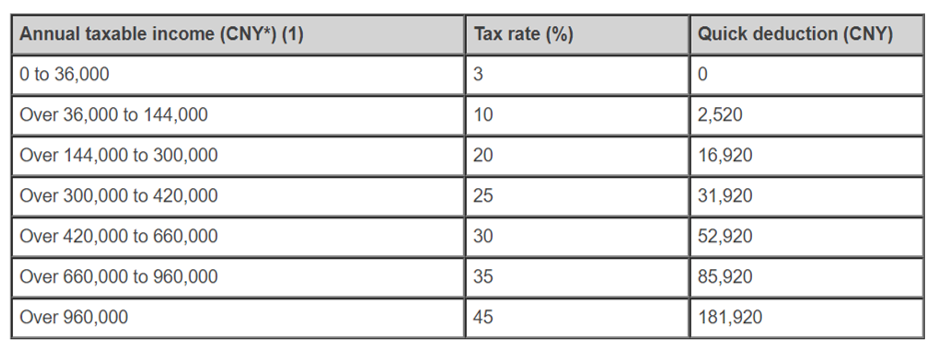

Salaries in China are quoted as a monthly amount, and tax is calculated as a percentage of your monthly income. Foreigners working in China have a monthly tax-free personal allowance of 3,000 RMB (36,000 RMB yearly). Any earnings over this amount will be taxed at the following rates:

Tax Calculation for Non-Resident (working in China for less than 5 years)

Tax Calculation for Resident (working continuously in China for over 5 years)

Quick Deduction = quick calculation to determine tax rate for your earnings

Calculating your tax rate

Foreign teachers in China tend to earn between 5000 and 16,000 RMB per month. If your school has quoted your gross salary (before tax), you can use the calculation below to find out how much you will take home each month:

Monthly income – 3,000 RMB = Monthly Taxable Income

Monthly Taxable Income x Tax Rate – Quick Deduction = Tax Payable

Here are some examples:

| Gross Salary: 7000 RMB | Gross Salary: 10,000 RMB | Gross Salary: 16,000 RMB |

|---|---|---|

| 7,000 – 3,000 = 4,000 | 10,000 – 3,000 = 7,000 | 16,000 – 3,000 = 13,000 |

| 4,000 x 0.10 – 210 = 190 | 7,000 x 0.10 – 210 = 490 | 13,000 x 0.20 – 1,410 = 1,190 |

| 7,000 – 190 = 6,810 | 10,000 – 490 = 9,510 | 16,000 – 1,190 = 14,810 |

| Net Salary: 6,810 RMB | Net Salary: 9,510 RMB | Net Salary: 14,810 RMB |

* Salaries are calculated on a monthly basis.

If you want to double check how much you will receive per month, ask your school contact who will be able to help!

Are you ready to apply for a teaching job in China? You can apply here

Considering other teaching destinations? Check out our programs in Thailand, Vietnam, Hungary and Poland with our other brand Impact Teaching